BRIDGETOWN, Barbados – The Governor of the Central Bank of Barbados, (CBB), Dr. Kevin Greenidge, Friday predicted that the Barbados economy is poised to maintain a robust growth trajectory through the rest of 2025 and into the medium-term.

Governor of the Central Bank of Barbados, Dr. Kevin Greenidge, reviewing the Barbados economy for the first six months of this year (CMC Photo)Addressing a review of the Barbados economic performance for the first six months of this year, Greenidge said that the momentum in real gross domestic product (GDP) recorded between January and June this year is expected to continue into the second half, and full-year growth is projected at approximately 2.7 percent.

Governor of the Central Bank of Barbados, Dr. Kevin Greenidge, reviewing the Barbados economy for the first six months of this year (CMC Photo)Addressing a review of the Barbados economic performance for the first six months of this year, Greenidge said that the momentum in real gross domestic product (GDP) recorded between January and June this year is expected to continue into the second half, and full-year growth is projected at approximately 2.7 percent.

He said unemployment has declined to its lowest level in recent history, reinforcing business confidence and household spending.

“Building on this resilience, the economy is forecasted to sustain around three per cent annual growth beyond 2025, supported by tourism diversification, public and private investment in infrastructure and housing, expansion of the digital economy, and targeted productivity reforms,” Greenidge said, adding that together, these drivers reinforce a confident outlook for continued, inclusive growth through 2025 and beyond.

Earlier, he told reporters that the economy sustained its growth trajectory, despite intensifying global risks. He said real GDP expanded by an estimated 2.5 percent during the first half of 2025, driven by strong activity in construction, business and other services, wholesale & retail trade, and tourism.

“The country held its growth trajectory even as geopolitical tensions escalated and global trade conditions worsened. This momentum pushed the unemployment rate down to a record low of 6.3 percent in the first quarter,” Greenidge added.

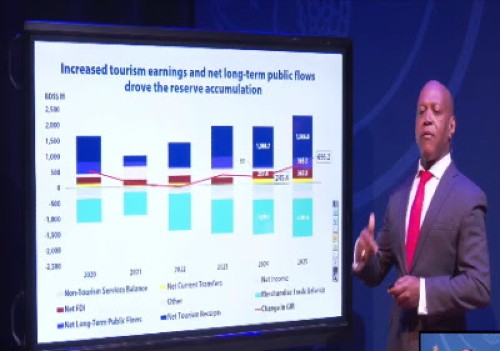

The CBB Governor said Barbados external position improved in the first half of 2025, supported by increased foreign investment, and a strong tourism performance.

He said foreign investment rose sharply, reflecting improved investor confidence and increased financing to both the public and private sectors.

“These inflows helped to offset a widening current account deficit, which reflected higher merchandise imports, increased profit repatriation, and a marginal decline in corporation tax receipts from financial global business companies, even as travel receipts posted strong gains.

“As a result, international reserves expanded by BDS$695.2 million (One BDS=US$0.50 cents), reaching a record BDS$3.9 billion, equivalent to 37.4 weeks of import cover, and well above the international benchmark.”

Greenidge said that the government continued to strengthen its fiscal position during the first quarter, (April to June) of the fiscal year, 2025/26.

He said higher income and transaction-based tax receipts outpaced spending on wages and salaries, goods and services, transfers and subsidies, and capital investment.

“This performance generated a fiscal surplus of BDS$372.9 million, equal to 2.4 percent of GDP, and a primary surplus of BDS$530.9 million, or 3.5 percent of GDP. Economic growth and the fiscal surplus lowered the debt-to-GDP ratio to 102 percent, a decline of 0.9 percentage points compared to the end of financial year 2024/25,” the Central Bank Governor said.

The CBB said that tourism and non-traded sector activity drove growth in the first half of the year. Output in the traded sector rose by 3.9 percent, as gains in tourism and agriculture offset declines in manufacturing.

Growth in construction, business and other services, and wholesale and retail trade contributed to a 2.3 percent increase in non-traded sector activity. Combined, these developments lifted real GDP by an estimated 2.5 percent during the period, the bank said.

Greenidge said that key sectors are positioned for continued expansion and that the tourism industry remains a primary engine of growth, supported by broadened market outreach and upgraded offerings.

“Overall, tourism activity is expected to increase during 2025, with cruise visitor activity set to exceed last year’s levels. This buoyant tourism outlook will stimulate related areas such as hospitality, transportation, and entertainment.

“In the construction sector, a pipeline of major projects, ranging from transport infrastructure and utility upgrades to new housing developments and renewable energy installations, should sustain high activity levels.

“Business and other services are also poised for growth, bolstered by ongoing investments in the digital sector and the international business arena,” Greenidge said, noting that targeted initiatives in agriculture and manufacturing are helping those industries adapt to challenges, laying the groundwork for gradual recovery.

“Overall, diverse sectoral gains are projected to support job creation and income growth across the economy,” he added.

The Central Bank Governor said that structural reforms in the digital economy and productivity enhancement will underpin sustainable medium-term growth.

He said Barbados is actively implementing measures to further modernize its economy, from expanding digital infrastructure to streamlining business regulations, which will improve competitiveness and open new growth avenues.

“The government’s digitalization push, including efforts to move towards a digital payments system by March 2026 and broad adoption of government services, is expected to boost efficiency and foster innovation.

“At the same time, targeted productivity reforms, such as investing in workforce skills and education, and reducing the red tape required to start businesses, will raise the economy’s potential output.”

Greenidge said that while the domestic outlook remains strong, Barbados continues to monitor external risks in an uncertain global environment.

He said that global growth is expected to slow to 2.8 percent in 2025 amid rising trade tensions and tighter global financial conditions.

“Any downturn in major source markets, particularly the US, could soften tourism demand, exports, and remittances. Elevated oil prices or new trade barriers also pose risks to import costs and travel sentiment.

“Even so, Barbados enters this period from a position of strength. International reserves have reached a record high, providing over nine months of import cover – a buffer that, alongside sound macroeconomic management, will help insulate the economy from external shocks.

“Recent positive developments, including the suspension of select global tariffs and easing of regional port fee proposals, have also improved the near-term outlook. On balance, strong fundamentals and proactive policy responses place Barbados in a favorable position to manage global uncertainty,” Greenidge said.

He said that inflation is expected to remain low and stable.

He noted that after decelerating sharply and registering only minimal price increases in the first half of 2025, domestic inflation is projected to rise gradually, with the 12-month moving average inflation rate anticipated to stabilize between 1.7 and 3.5 percent.

However, he said, several external risks could derail the outlook.

The Central Bank Governor says heightened geopolitical tensions in oil-producing regions, the reintroduction of production cuts by the Organization of Petroleum Exporting Countries (OPEC) plus members, and the increase in tariff rates by major trading partners, are likely to place upward pressure on local prices.

“Price levels at home are benefitting from government initiatives to boost food security and renewable energy, which help insulate consumers from external price swings. While potential spikes in oil prices or shipping costs, as well as domestic weather-related disruptions to food production, could pose transient upward risks, the overall outlook is for inflation to remain within a manageable range. This benign inflationary environment will help preserve purchasing power and support confidence in the economy.”

He said public finances are on a path of further strengthening and that the government’s fiscal stance continues to prioritize the balance between supporting growth and ensuring debt sustainability.

Greenidge said building on a solid first quarter of this financial year, which featured healthy revenue collections and a strong primary surplus, government remains committed to meeting annual fiscal targets through enhanced revenue and careful spending.

He said ongoing tax administration reforms and the adoption of new global tax standards are expected to improve collections, providing upside potential for government revenues.

“These efforts create space for continued investment in critical infrastructure and climate resilience initiatives, even as fiscal discipline is maintained.”

Greenidge said sustained economic growth and prudent budget management are set to keep the public debt on a downward trajectory, with the debt-to-GDP ratio projected to decline steadily toward the 60 percent benchmark by financial year 2035/36.

“Favorable global financial conditions, including the prospect of lower international interest rates, could further ease debt servicing costs, reinforcing the positive debt dynamics. Overall, the fiscal and debt outlook is one of gradual improvement, marked by continued surpluses, moderating debt levels, and increased resilience to future shocks.”

He said that the financial sector is set to remain resilient and supportive of growth and that financial soundness indicators are strong and forecasted to stay robust through year-end. “Banks and other deposit-taking institutions are well-capitalized and highly liquid, positioning them to comfortably meet credit demand as business activity rises. Private sector credit growth is set to accelerate moderately, underpinned by increased lending to the housing market and businesses for new investment projects.

“In particular, ongoing construction and real estate developments, as well as the needs of a growing services sector, are sustaining higher demand for loans, a trend banks are well-equipped to accommodate.”

Greenidge said loan quality continues to improve, with non-performing loan ratios at their lowest levels in over a decade, and further declines anticipated as borrowers benefit from the stronger economy and lower borrowing costs.

“Meanwhile, deposit growth is likely to persist given rising incomes and the still-elevated national saving rate, although faster import growth could temper the pace of accumulation. Profitability in the banking sector remains stable, supporting intermediaries’ capacity to lend. “Overall, the financial sector’s stability and depth provide a solid underpinning for Barbados’ growth prospects. As the nation presses ahead with its development goals, a resilient financial system, alongside prudent regulation, will ensure that credit flows to productive sectors, thereby amplifying economic momentum.

“Armed with strengthened buffers and a strong economy, Barbados is confidently moving forward. By continuing to invest in its people, infrastructure, and innovative industries, and by fostering close collaboration between the public and private sectors, Barbados can sustain its growth momentum and secure a prosperous, inclusive future for all,’ Greenidge said.